Last year’s Tax Cuts and Jobs Act made Section 179 deductions permanent, extending an important tool in small business year-end tax planning. It allows for a significant increase in medical equipment and other tangible property write-offs.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy or lease a piece of qualifying equipment between January 1 and December 31, you can deduct the full purchase price from your gross income. It’s an incentive created by the U.S. government to encourage businesses to reinvest in their growth.

What does that mean for your year-end planning? First, see your tax accountant to better understand your tax liability and whether it makes sense to pull forward any planned purchases.

Second, many equipment or software purchases will meet the qualifications for Section 125. Ask yourself:

- Am I spending money just to reduce tax burden?

- Will this open up new revenue streams for my practice?

- Is this a good fit for my patient demographic and needs?

- Will it improve my standard of care?

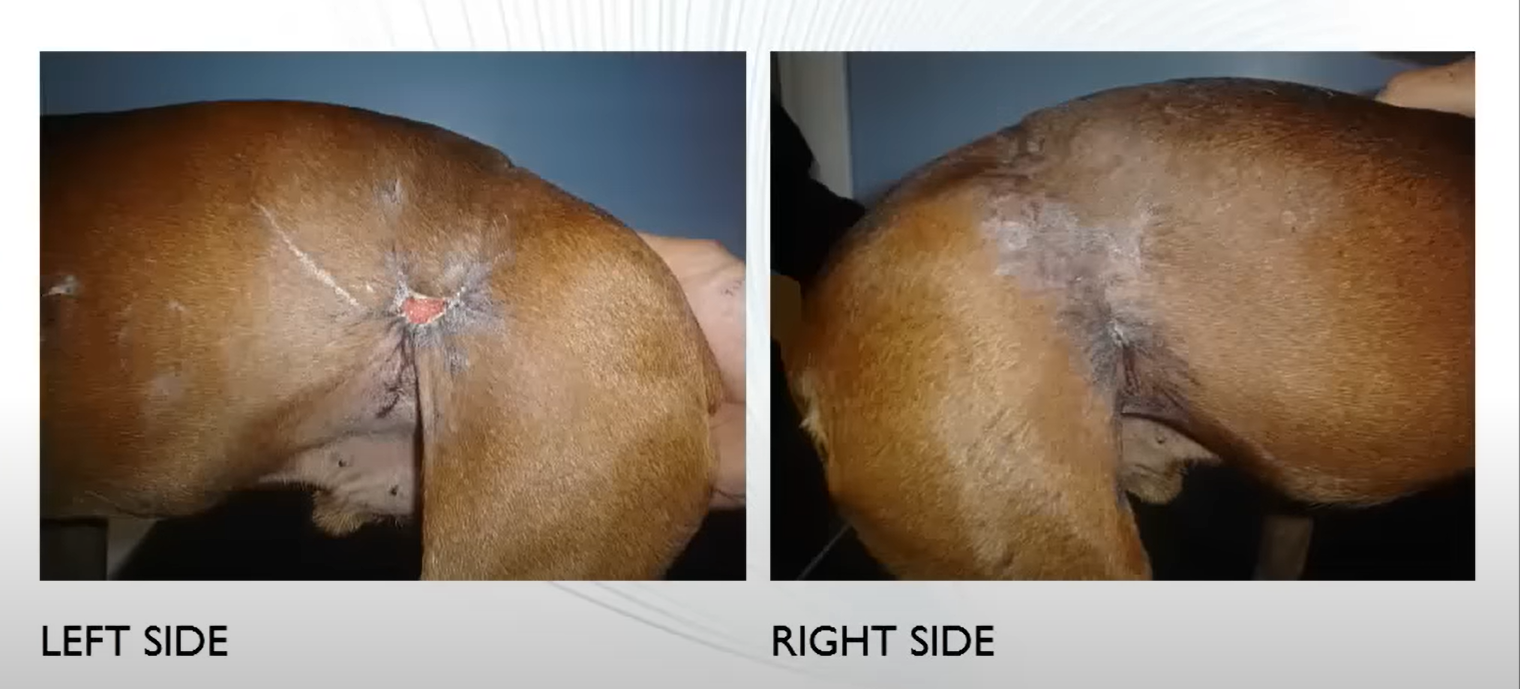

While physicians in many specialties, including orthopedics, look to 2020 and the increasing demands on their practice, MLS lasers present a viable alternative to prescription pain relief, and an additional revenue stream. In the face of rapidly changing state legislature in response to the opioid crisis, and an aging population, medical laser equipment is an area of need for many growing practices.

Is MLS right for you?

A well-considered fourth quarter investment in laser therapy could represent significant tax savings. The scenario below is an example of this cost savings:

At a 37% tax bracket:

- $30,000 equipment purchase or lease

- $11,100 tax savings

- $85,000 – 125,000 revenue potential/year

Visit the Section 179 website to calculate your potential tax savings.

Plan ahead!

To be eligible for Section 179, new equipment, such as an MLS Laser, must be purchased and in use by December 31st.

Contact us to discuss your needs and timeline.